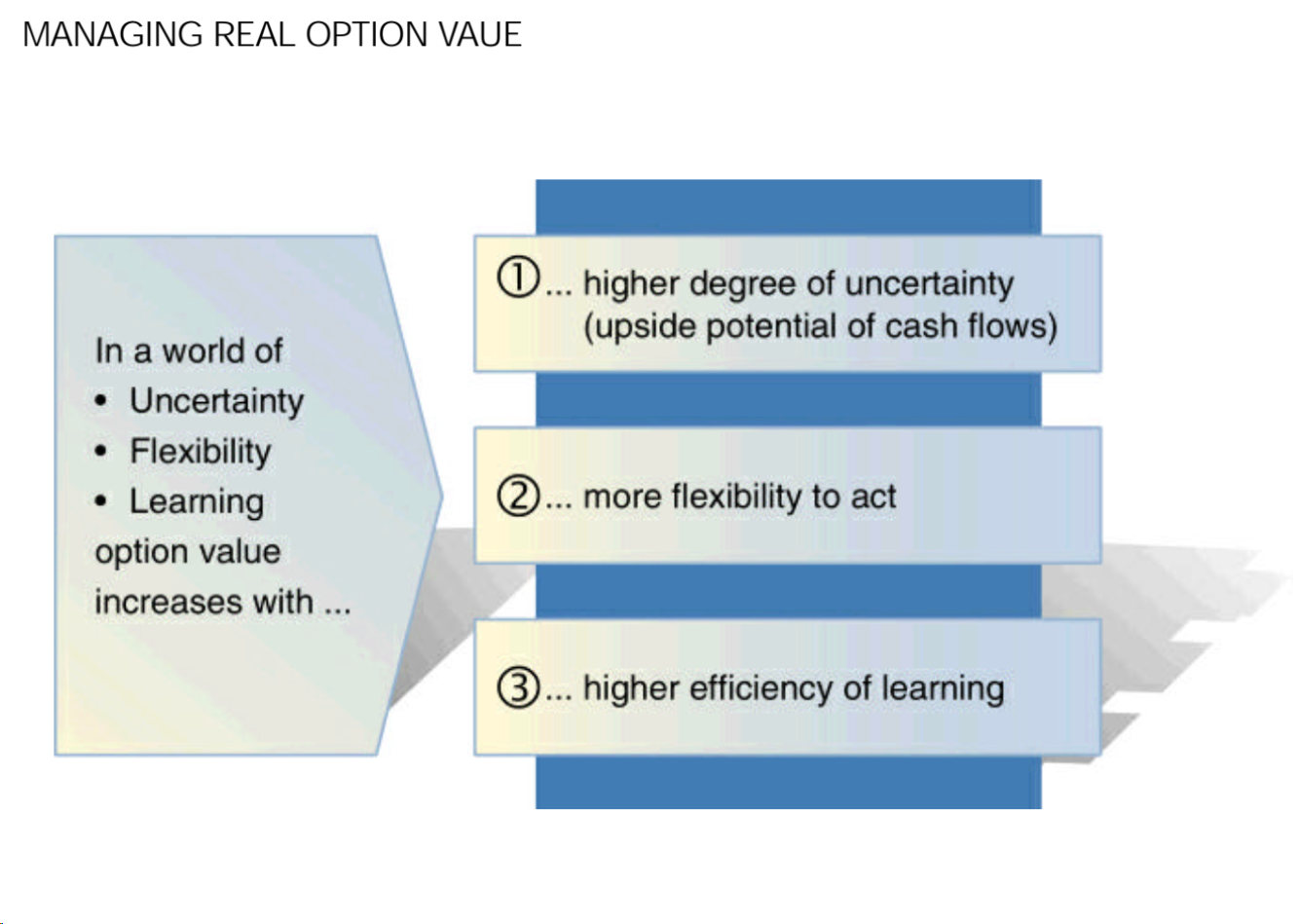

Option theory enables biopharmaceutical and other companies to value their investments not only on the basis of what is known or expected, but also on what is not yet known or what is uncertain. It helps decision-makers identify uncertainties and flexibility and extract inherent option value.

The key to optimizing option value is to resolve “killer risks” early. To improve learning efficiency, managers should pay for information related to externally important, value-driving milestones, maxizing the “Learning On Investment” rate (LOI).