Global pharmaceutical companies are re-looking at their R&D processes in order to leverage the opportunity presented by emerging economies, such as India, in contract research. Besides offering the opportunity to save costs tactically in the short term, this is also a strategic move to improve productivity and develop further capabilities in order to compete successfully in the future, while staying close to geographies which will drive future growth.

Declining productivity, relatively dry pipeline for new drugs, increasing penetration of generics and margin pressures have been leading to lower profitability for global pharmaceutical companies. This trend is expected to further intensify going forward into the future. This has forced companies to continuously adapt their cost structures, as exemplified by major multi-billion cost cutting/restructuring projects in many major pharmaceutical companies, as announced most recently.

The pharmaceutical industry is fundamentally re-evaluating the make-up of its value chain, differentiating clearly between core capabilities and those that could be potentially outsourced. Within R&D, particularly pre-clinical and discovery seem to be representing potential outsourcing opportunities, also driven by huge cost differences. In the future, the pharmaceutical industry will be forced to capture the increasing benefits from emerging countries, particularly given the longterm benefit from matching better its global work force footprint to the future geographic distribution of revenues.

Many key success factors for pharmaceutical R&D apply equally to all phases, such as the availability of highly skilled English speaking staff, adherence to quality and compliance, flexibility and agility given significant attrition, costs per unit (related for example to activity, FTEs, patients) and tight project management. In addition, exploratory R&D also requires IP protection, trained/ experienced scientists/ researchers, speed of learning/ know-how development, access to academia/ basic research labs, as well as access to funding whether public or private. In case of confirmatory R&D, the key success factors are driven by fast access to patients, local regulations for animal/ clinical studies, overall speed for critical path activities, e.g. data analysis upon database lock of clinical trials, access to product approval regulators and cost/benefit assessment agencies in key markets as well as strength of relationships with medical opinion leaders driving product adoption through international and national guidelines.

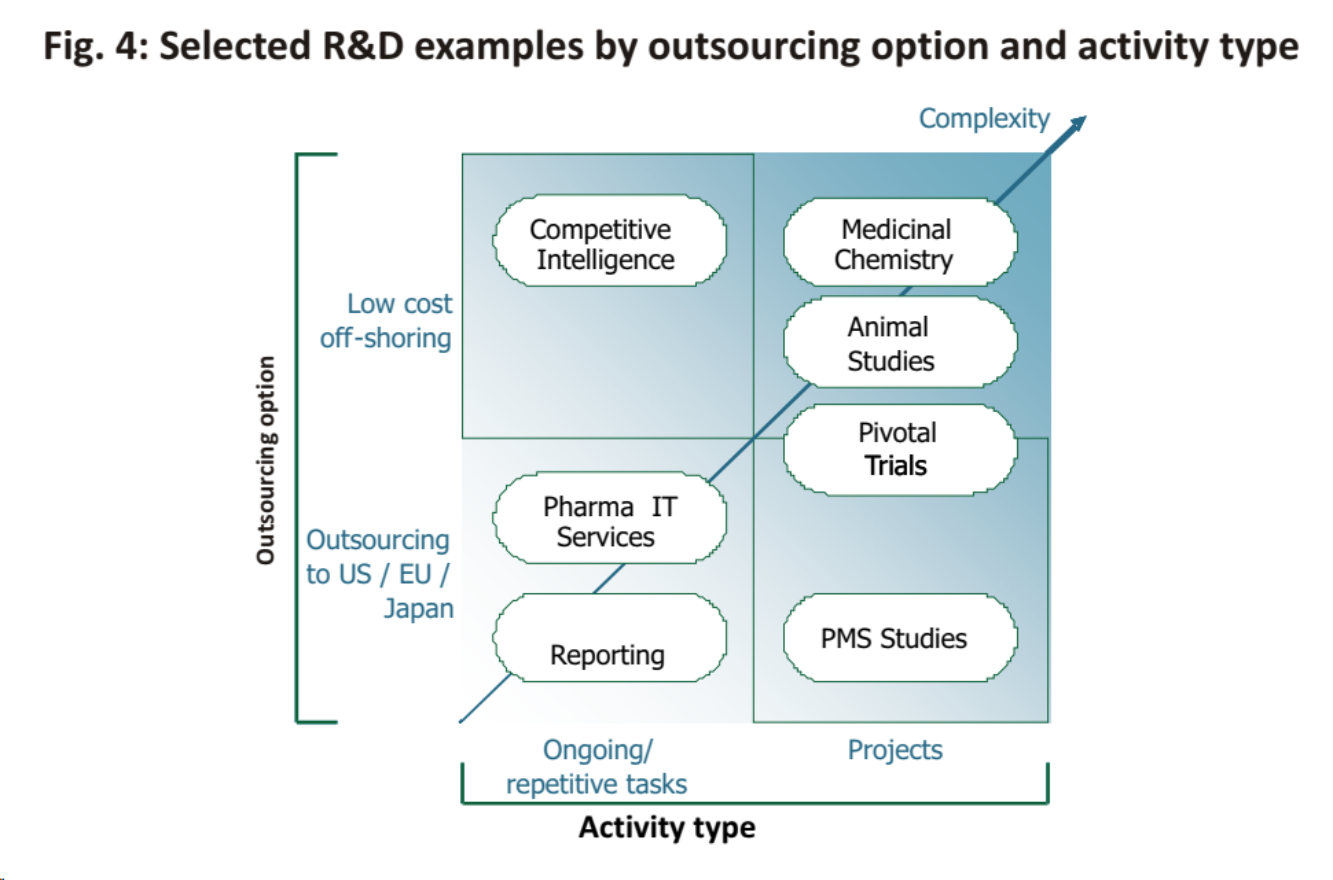

Pharmaceutical companies need to decide on their geographic footprint by assessing the various locations rigorously against the suggested key success factors. In addition, we suggest differentiating outsourcing decisions by activity type (differentiating ongoing/ repetitive tasks from projects) and outsourcing option (off-shoring leading to a strategic cost advantage vs. outsourcing within US/ EU/ Japan). Near and offshoring seems to be equally driven by unit cost advantages, e.g. animal studies, as well as critical resource access, e.g. patients meeting clinical trial inclusion criteria, experienced medicinal chemists.

It is a foregone conclusion that pharmaceutical and biotech companies need to relook at their business models if they have to successfully compete in the new environment. Contract manufacturing was just the tip of the iceberg. If companies have to be really successful and optimize their operations for better business results, they need to revamp their R&D process and capture the opportunity presented by emerging economies. Price realizations that the pharma companies have got used to may be a thing of the past, especially with focus on reducing final cost of dose by payers and governments even in the developed world. Off-shoring contract research (and manufacturing) services are therefore an opportunity to not just save costs tactically for the short term, but also a strategic move to improve productivity and develop further capabilities, while also moving closer to the future healthcare customers in developing markets.