Thanks to its international experience, the Swiss medical technology sector is well aware of the latest developments in the healthcare market, especially as smaller companies also tend to work the European markets bordering Switzerland intensively and directly.

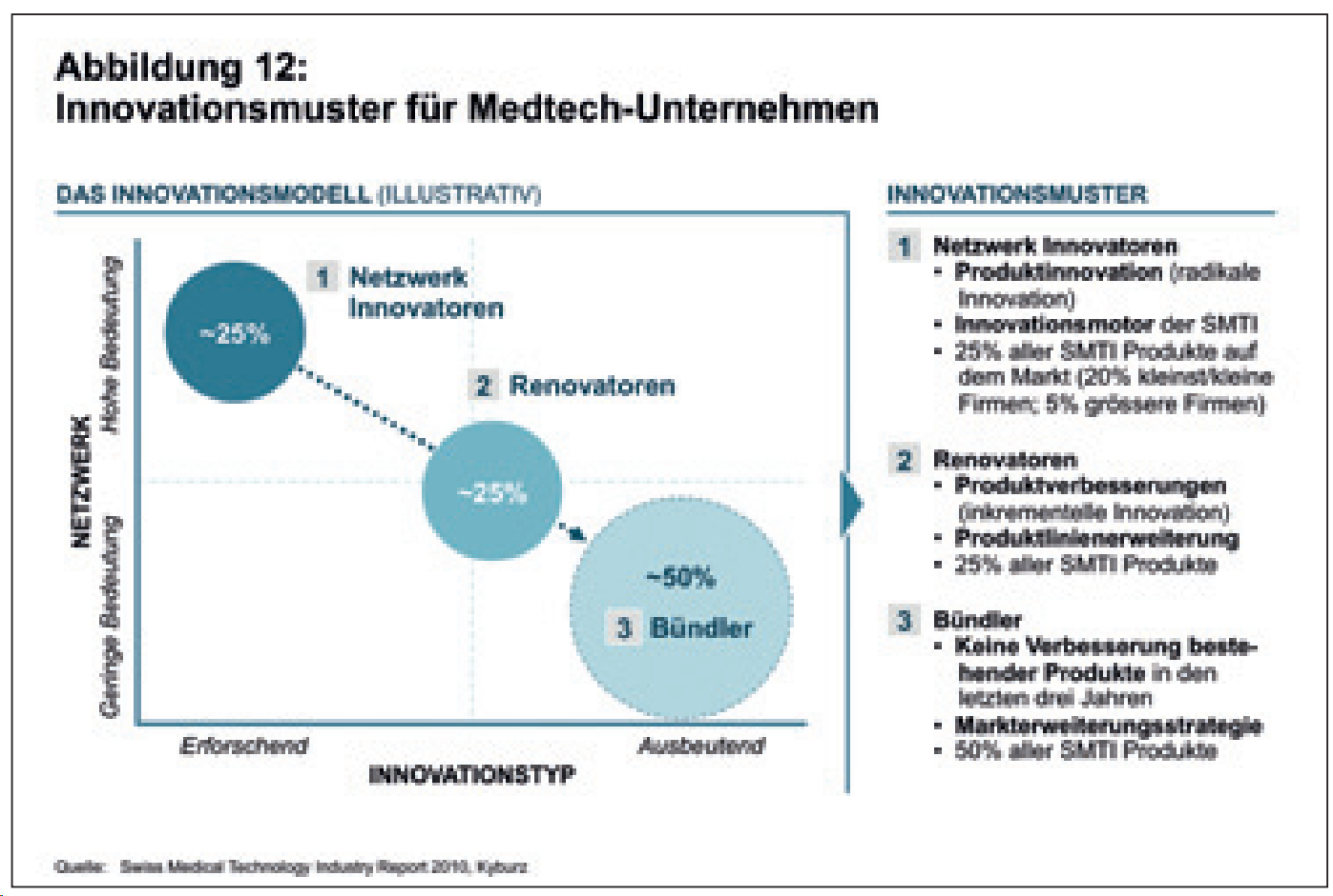

In the new field of tension, medical technology providers can apply various strategies. New or smaller companies can continue to act as radical innovators, focusing primarily on radical product innovation in the network. These niche providers will certainly achieve high margins for unavoidable medically necessary specialty products. Innovators can continue to focus their market development on physicians as decision-makers.

After the introduction of the DRG, however, there must be a significant medical advantage to the relevant items in order for doctors to be allowed to demand them regardless of higher prices. In addition, the purchasing department must also be convinced with regard to the overall costs of the innovation, and savings for the entire healthcare system must be convincingly demonstrated, for example shorter hospitalization times for patients or reduced complication rates.

The majority of established medical technology providers do not generally have a broad range of relevant products to position themselves exclusively as radical innovators. In the past, so-called “renovators” have been able to achieve attractive margins with incremental innovations and product line extensions. In the future, this strategy will become increasingly risky, as many established medical technology companies have the opportunity to position themselves as bundlers of existing products without significant improvement. Successful bundlers position themselves with as many hospitals as possible as high-volume standard suppliers with lower margins and higher, guaranteed quantities. In addition, successful bundlers can distinguish themselves through other success factors, such as delivery reliability, avoidance of complications and compatibility and networkability with existing hospital systems. Thanks to their cost leadership in products, these companies can focus on the purchasing of large and medium-sized hospitals and relevant purchasing groups as decision-makers. In addition, bundlers can position themselves as partners to hospitals if they can credibly support hospital management in their cost-cutting efforts, for example reducing process costs and/or standardizing the product range.