The European healthcare industry faces a multitude of challenges. Demographic changes and medical innovations are driving up the overall demand and expenditure. Because of the resultant decrease in financial leeway, the public sector is retreating as the main provider of healthcare services, and private suppliers are moving into the market. At the same time, patients and insurance companies are striving for better information on treatment costs and quality. These changes are reflected in industry trends. Providers, such as pharmaceutical companies increasingly understand themselves not only as product suppliers but as service providers. Payers have already begun to offer targets and financial incentives to their service and product suppliers. Finally, both payors and providers have started entering into innovative forms of co-operation. A fresh approach to commercialisation is essential for success in the new market environment. However, it can also require drastic changes, as companies must redefine their business models.

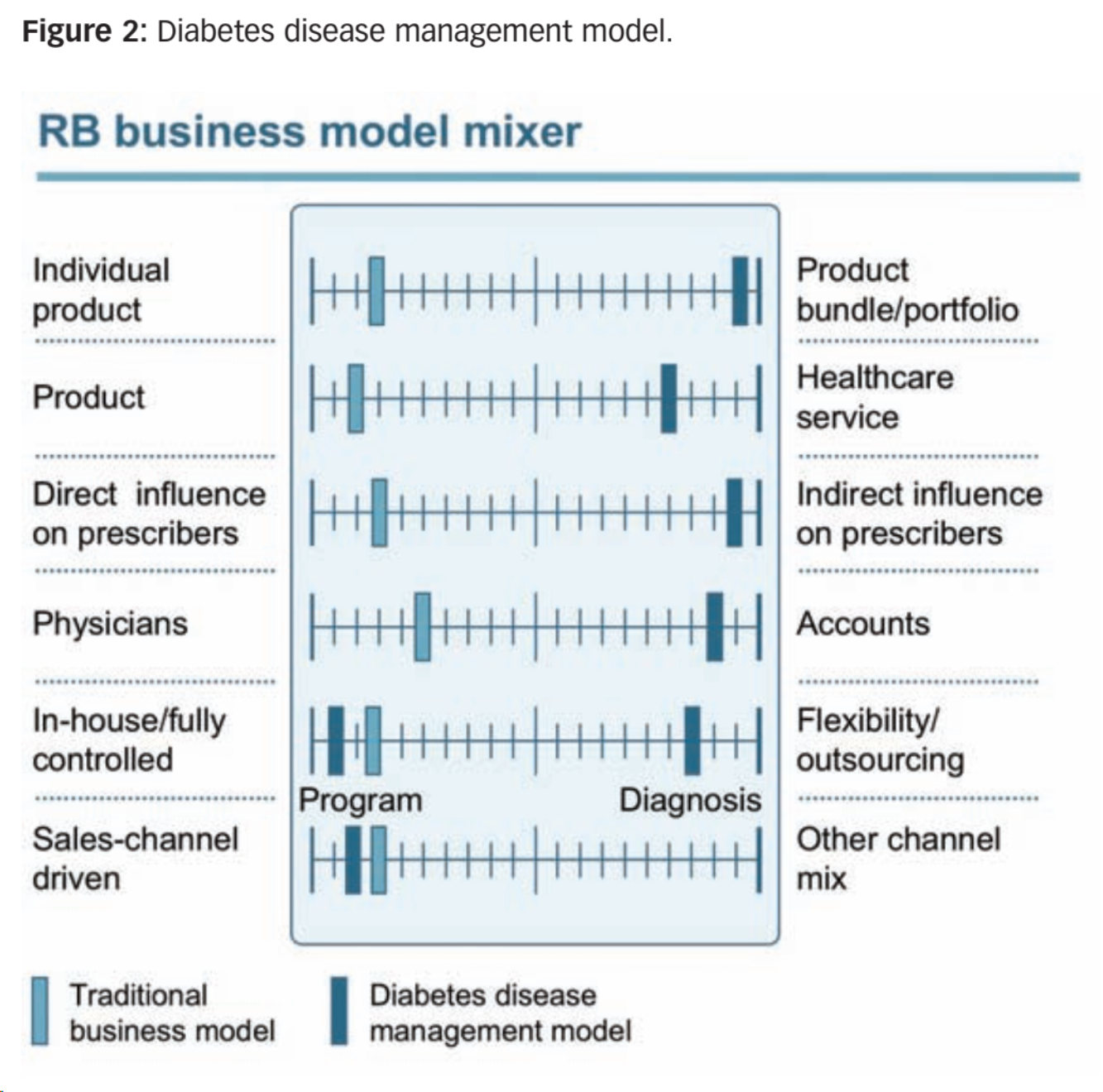

There isn’t just one ‘most successful’ new business model. Each depends on the individual company’s products, customers and competitive situation. To determine the bedrock of the new business companies have to define their focus areas first along the following six dimensions:

● from individual products to product bundles/ portfolios

● from product to healthcare services

● from direct to indirect influence on prescribers

● from physicians to accounts

● from full in-house control to flexibility/outsourcing

● from a focus on sales channel to an emphasis on other channels

How a company positions itself in terms of these dimensions defines the characteristic attributes of its new business model. For example, the company can choose to focus either on accounts or on prescribers. Similarly, it can choose between the two extremes of individual product offerings or product bundles. The company’s choice has a formative influence on its sales approach and offerings, and thereby on the business model that is ultimately adopted.

New business models have to be developed for each country as they need to be tailored to country-specific requirements and prerequisites for profitability. This includes determining key dominant external stakeholders and corresponding value propositions, deriving potential options for new business models, assessing them in terms of impact and feasibility and identifying the best environment for quick and pragmatic testing. While such pilot programmes cannot fully eliminate all uncertainty, they enable pharmaceutical companies to take calculated risks. Since 72% of pharmaceutical managers believe that their companies will introduce fundamentally new business models in the next two years in light of challenges in the healthcare environment, it can be assumed that companies that don´t risk change will fail in the medium term.