The healthcare environment has been transforming faster during the last couple of years. New approaches for managing, financing and competing in healthcare are pushing all players in the sector to constantly question the relevance of their formula for past success. As a result, all suppliers of healthcare products, including those in the medtech industry, experience more pressure on their top and bottom line.

New trends in healthcare regarding management, financing and competition are broadly transforming the medtech sector in the near future. Public cost containment is a major driver behind these developments, enforced by the financial crisis. In the last ten years, relative healthcare expenditures (in % of GDP) have constantly risen. Local healthcare systems struggle to finance the rising cost burden with the patient playing an increasingly important role in healthcare financing.

Competing in healthcare has already been impacted by a new world order where countries like China and Brazil are presenting larger opportunities than traditional markets. In this world, established Western companies need to adapt to different competitive and economic environments as well as changing customer needs. It also means that traditional home markets are becoming threatened by new competitors originating from emerging countries.

Finally, how objectives are being reached in healthcare is changing. While quality and innovation were the key success factors in the past, managing healthcare is more and more about balancing cost and quality.

According to industry executives, these trends can impact medtech in both positive and negative ways. Medtech executives universally see opportunities resulting from trends such as specialization within healthcare delivery in combination with consistent costs and quality criteria, raising the bar on a scalable basis.

Positive impact on the sector is also expected from novel competition in healthcare resulting from forward integration of healthcare product companies and the development of virtual value chains. Increasing cost pressure forced hospitals to focus on their core health provision activities by outsourcing non-core activities like lab services, catering, rehabilitation, etc., to specialized external providers.

Another healthcare trend predominantly seen as negatively impacting the medtech industry is the increasing focus on outcomes due to the increasing restrictions imposed on healthcare professionals with regards to supplier/product sourcing decisions, as indicated by the global proliferation of Health Technology Assessments (HTA). Cost implications for the healthcare system become the decisive factor when existing product alternatives are not significantly different from one another. When proving outcomes is a condition to receiving payment, medtech players have to invest in building up capabilities and resources for long-term outcome assessments and management of new stakeholders such as HTA bodies and scientific societies which are influencing healthcare funding. These endeavors do not come cheap and easy: long-term studies (i.e. 10 years) often extend over multiple, incremental innovation cycles and need to reflect products at both study initiation and completion in order to be credible, increasingly requiring strategic collaborations between medtech companies and healthcare players.

While the medtech success formula of the past was focused on delivering high quality products, there is now a move towards integration of healthcare delivery with a focus on overall treatment solutions. More than 50% of medtech experts believe that the medtech sector will transform itself through strategic shifts building on the past.

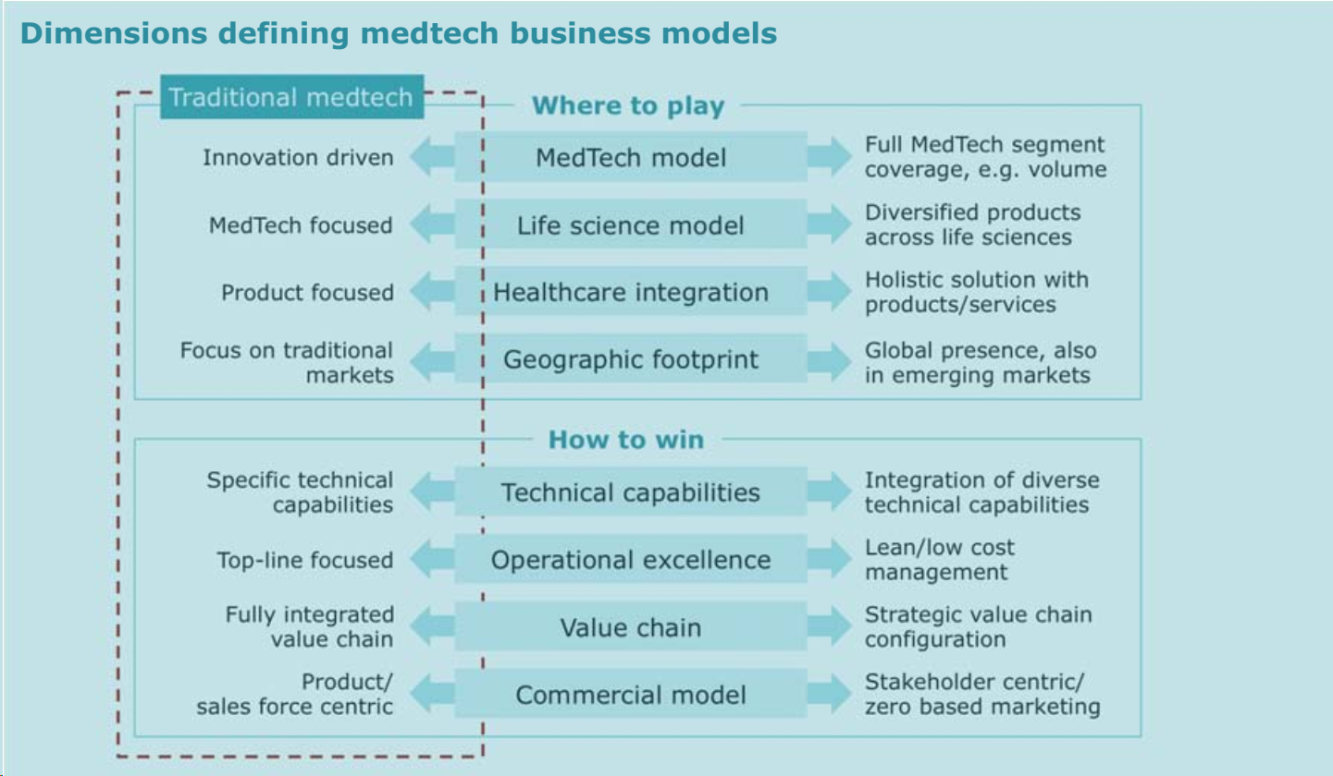

We propose eight strategic levers which need to be decided by each company. “where to play” levers determine the level of divergence from the traditional Western focused product markets to offering a broader portfolio of healthcare products and/or solutions globally. “how to win” strategic levers enable medtech companies to execute the selected “where to play” strategy effectively and efficiently. These levers refer to the companies’ value chain configuration, processes and capabilities.

Medtech executives believe different levers will achieve the most impact with regards to top-line growth and bottom-line protection over the next 5 years. A third of medtech executives believe that forward integration will be the most attractive with regards to top-line growth while also offering bottom-line protection in the coming 5 years.

A third of medtech executives believe that decisions regarding the geographic footprint will be most attractive with regards to top-line growth in the coming 5 years while also offering bottomline protection. Today, presence in emerging markets is regarded not as an option but rather as an obligation. However, future oriented players do not limit their engagements to commercialization.

Across many countries medtech companies will face challenging price negotiations with hospitals who themselves have to protect their margins in increasingly cost-focused healthcare systems. Almost a third of medtech experts questioned expect operational excellence, focusing on lean/low cost management to offer the best bottom line protection over the next 5 years thus buying time for strategic changes. Efforts to significantly improve operational expenses have been an ongoing theme for the last 5 years, potentially leading to a severe lack of vital resources to turn around the business through applying new business models.

More than 40% of medtech executives believe that the sector will lead the way in changing healthcare by adapting its current business model. Regarding the role of medtech firms in the healthcare transition process, expert opinions are divided. While almost half of respondents think the medtech sector will play a minor role, more than 40% believe that the sector will actually lead the way in changing healthcare by adapting its current business models.

As always there is no “one size fits all” recipe to master this enormous challenge. Appropriate approaches depend on the specific situation determined by the market, healthcare segment and local healthcare funding. The most critical step is to first build a solid and strategic foundation by picking the right market and segment and start in geographies that offer a favorable environment. Western players in renal care for instance established public/private partnership models across Eastern European countries in order to build up the infrastructure for these markets first.

Essentially, medtech companies have to make decisions along two major dimensions. First, they need to select offerings and business models which focus on the product; ranging from specialized, innovative products to broad, generalized medtech and life sciences products. Secondly, they need to decide on their commercial strategies, which must embody both a pure product focus on one end and holistic healthcare treatment solutions on the other. In addition, strategies will focus on superior outcomes, process optimization and cost efficiency. As long as medtech companies focus on products, they can only compete with four major medtech models, differentiated by outcome/total healthcare costs improvement and unique product positioning.

Clearly, medtech executives are doing their best to tackle the necessary fundamental changes successfully to secure long-term survival of their corporations. Most recognize the many opportunities changes in healthcare will provide and are making their strategic decisions as the future unfolds. While implementing their visions, some are not only transforming their own corporations but also the overall medtech and healthcare sectors. The ongoing identification and implementation of the success formula of the future poses risks, but it is certainly less risky than standing still and hanging onto the past for too long until it will be too late to change.