Health care has always been an issue of great significance. But never before has it been more important than today: With economies shifting from an industrial to a more service-orientated approach, this sector is allocated a very high percentage of Gross Domestic Product (GDP). Health care also has a huge impact on employment, due to the fact that most related activities are provided by people.

Yet the industry and its players are facing a multitude of obstacles. Macroeconomic factors, such as aging populations or insufficient public funding, are challenging both payors and providers. Consequently, anyone wishing to succeed in this new market environment must redefine and adapt their business models accordingly. In this study, we will discuss key trends, and point to possible solutions. We will provide you with a road-map which will help you and your company to develop and implement the necessary moves.

This study starts by presenting you with an overview of selected European health care systems, and explain their respective similarities and differences. One of the similarities is that most countries spend between 9 and 12% of their GDP on health care alone – and in those countries, this sector is growing considerably faster than GDP itself. Another similarity is that in most countries, public bodies still provide the biggest part of funding. However, the individual hospital structures differ greatly.

Among the key trends are:

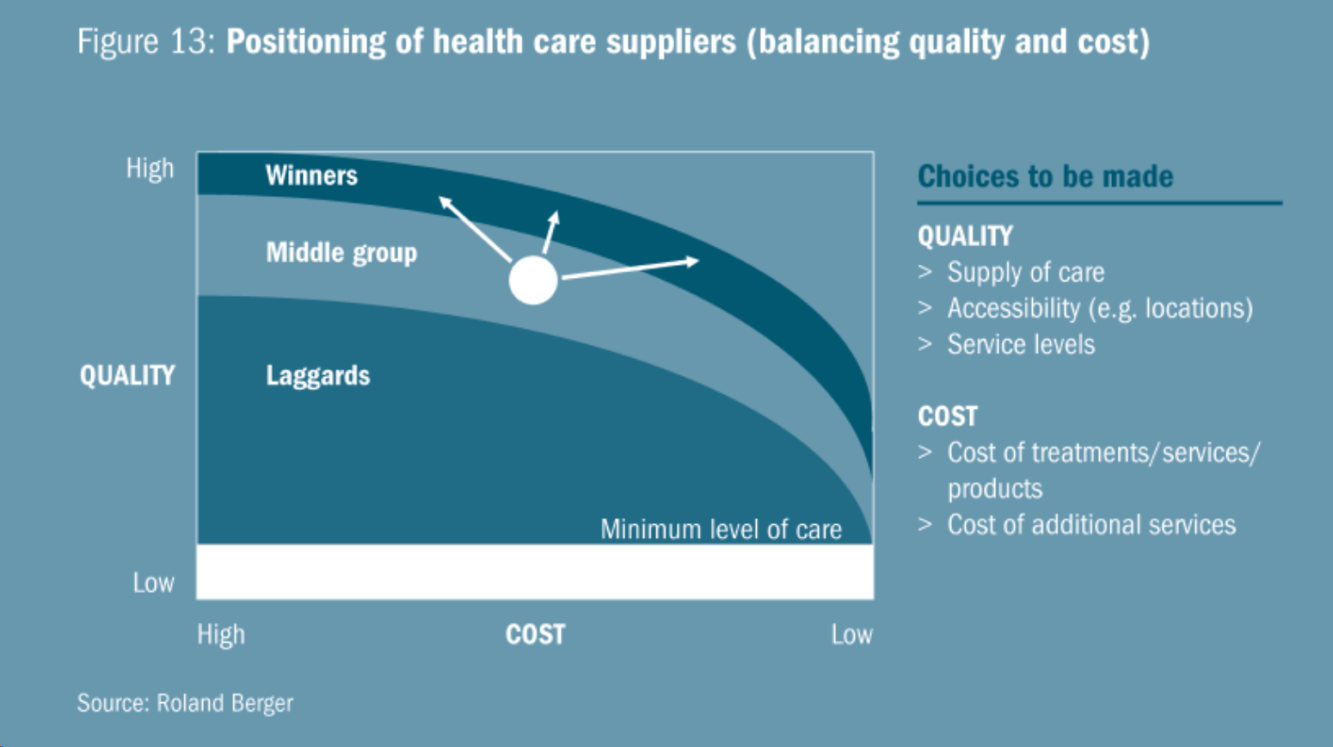

> Management Excellence: Performance is no longer measured by cost indicators alone. Instead, companies should focus on balancing quality & cost.

> From product to services: By offering more integrated services, companies no longer function as pure product suppliers, thereby they should offer more value to their clients (patients).

> Taking good care of yourself: A growing part of the population is willing to pay for health care out of their own pockets. As a result, a “secondary health care market” is developing.

> The rise of the specialist: Increasing scientific knowledge makes the health care industry more and more complex. Specialization is needed to enable the right quality & cost balance.

> Pay for Performance: Since performance indicators on quality are becoming more and more available, health insurance companies have begun to issue both targets and financial incentives to their service and product providers.

> From institution to brand: In an effort to win over increasingly well informed patients, health care players should develop a “brand” which allows them to distinguish themselves.

> Going private: The public deficit and costs are growing, provoking a trend towards privatization.

> The new virtual value chain: New providers are pushing into the market, and have entered into innovative forms of cooperation with the traditional players.

> Moving beyond boundaries: In search of better treatments or job opportunities, patients, health care workers and hospitals are becoming increasingly mobile.